A British Coda

Before the return of Trump sucks the oxygen from every other global story it’s worth revisiting, only a month on, the shambles which is UK policy towards China. A month ago, this column looked at the sorry state of UK policy towards China with the exposure that a United Front agent had direct access to Prince Andrew via his Pitch at Palace scheme. The need for the Labour government to get serious about China policy was all too evident. But since then, the developments have only soured and the hope that Prime Minister Starmer could meaningfully reframe China policy to reflect the new realities of Xi Jinping regime seems even less likely than a month ago.

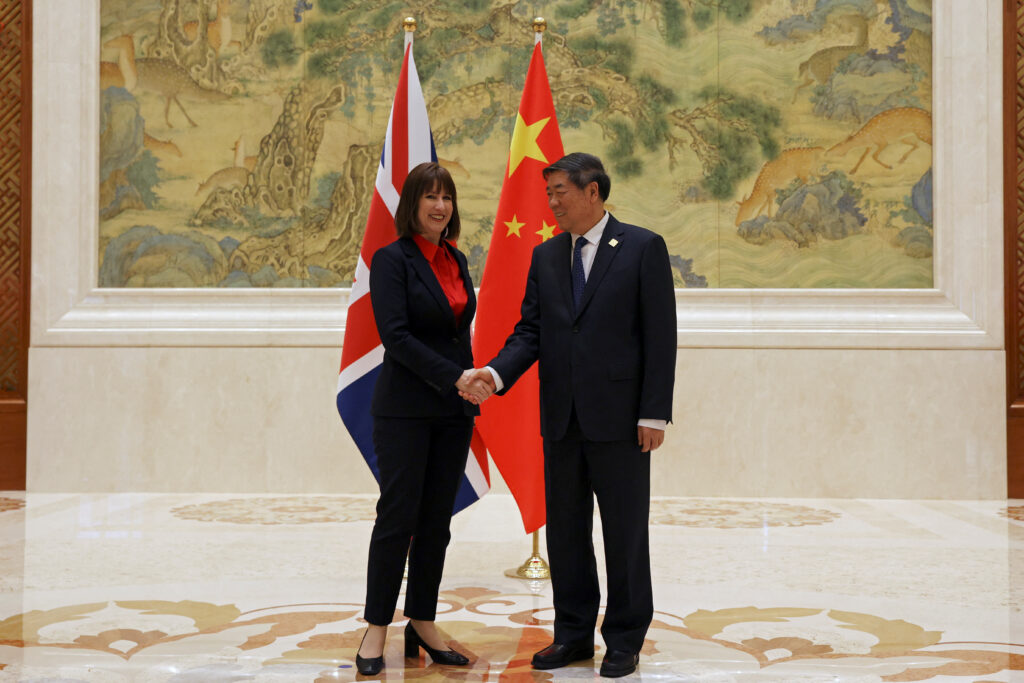

Early in the New Year Rachel Reeves, the UK Chancellor set off to China with a slew of businesspeople. The results of the trip were meager to nearly non-existent. Reading the joint statements of the meetings it reads like a Golden-era-lite advertisement. Lots about cooperation and financial market engagements, talk of level playing fields and opening of markets but these are phrases which have been written hundreds of times before in documents with China and have failed time and time again to produce anything. The headline number from the deal is almost too pitiful to mention. A measly 60o billion pounds of deals were announced, possibly rising to one billion pounds. That is truly laughable to make an impact on either economy. The UK economic is around 2.5 trillion pounds in size and China around 6 times that.

One prominent commentator used the old and tired argument that full disengagement with China is impossible and it is vital to engage and do business with China. Firstly, no one is suggesting that there is zero cooperation with China and that China’s economic size can be ignored in a global economy. But for the Chancellor to run off to China and parrot the usual boilerplate message about engagement with China as the world’s second largest economy is not only 20 years out of date but undermines any meaningful review of UK China relations which Starmer has promised. Whether such a review ever comes to anything substantial is doubtful. But domestic UK constraints are secondary. With the second Trump presidency any UK policy will need to bend to accommodate what the US wants. There is no way that Reeves China visit will delivery anything of substance if it goes against UK and US relations.

On the Eve

The curtain is about to rise on the second Trump presidency and now may actually be the highpoint of his second term because it might all start going down hill when he actually takes office and returns to the White House.

Trump’s return as the 47th president of the United States is a remarkable political comeback. He left office, unwillingly 4 years ago with abysmal popularity ratings and was even disowned by the senior leaders of the Republican party after he encouraged a group of his supporters to storm the Capitol building. He is not, as he would claim, returning on a landslide of popular support. He polled less than 50% of the popular vote and the Republicans hold very narrow majorities in the Congress. He assembled a broad coalition of support by saying whatever his audience wanted to hear yet the promises he made are simply incompatible. He isn’t going to deliver for everyone. His core voters came out in support for the time-honoured reason that many presidents or parties get kicked out of office. It’s the economy stupid. Many votes, experts in their lives, saw the high inflation of the Biden years severely cutting into their day-to-day economics and they remembered that previously under Trump they were better off. All the very real moral and personal failings simply don’t matter or at least don’t matter enough to disqualify him in the eyes of many American voters.

Trump is in back regardless of his flaws, but he starts this term effectively a lame duck president as he can only serve a single term. While anything is possible, or so it seems in today’s America, few would think he can either change the constitution to run for a third term, nor will he be able to engineer a coup to retain power, and if nothing else he enters the office as the oldest President, older than Biden when he assumed office, and nobody lives forever. So Trump must be gone in another four years, and with the usual mid-term elections coming in two years his time available to make a difference will be limited. He comes, as per last time, with no real policy or principles which drive him. Tariffs and immigration are perhaps the closest thing that he has to a political philosophy, but he remains highly transactional in any situation. To him every challenge or problem, whether it be in the domestic or international arena is something which can be bargained out or traded now for some particular outcome. Little, if any, thought is given to the longer-term consequences of his actions.

As the curtain rises on Trump 2 the blackout curtain has fallen over tiktok, at least in the USA. The tiktok ban approved by both the House and the Senate in Congress and confirmed by a 9-0 vote on the Supreme Court has gone into effect and the app is no longer available in the USA. Yet, it could still be resurrected by Trump when he returns to power, or so he claims. But it must be remembered that it was Trump in 2020 who first tried to ban tiktok via executive order only for that to be deemed unlawful and hence needed to go through Congress! Back then this was the anti-China Trump claiming he was protecting Americans’ data from possible abuse by the Chinese state. Fast forward 4 years and Trump sees tiktok has having helped drive younger voters to the polls to secure his victory. Nothing regarding data security or privacy has changed at tiktok and the Chinese state certainly hasn’t become any less hostile to the West but for Trump none of that matters. Nothing matters to him except his own promotion and position. If tiktok’s algorithm helped him win then it must be good. Welcome to Trump’s second term.

The real-world challenges

The spectacle of the Trump presidency certainly makes for good ratings. His endless ability to inflame passions, infuriate opponents or his willingness to say anything that comes into his head means he is always center of attention but such glib or offensive comments and soundbites are not a program for governance. He no doubt finds the reality of governance boring, for large periods of his first term the details of policy clearly bored him. The first time around he did have some very able people within his circle, but this time history repeats as farce. He has assembled a court of possibly the most unqualified people ever to assume such high office. The administration’s ability to tackle difficult issues is certainly going to be tested with such a poor cast of characters. Peter Hegseth the proposed defense secretary is wholly unqualified as the recent senate hearings showed. Hegseth is great in front of the television cameras, he is after all a FOX TV host but as Senator Tammy Duckworth exposed he could not name a single ASEAN country and in response said he did know the US had allies in South Korea, Japan and Australia. Hardly a promising start when the South China Sea and East China Sea are likely to be geo-political flashpoints in the coming years.

But Trump’s MAGA base didn’t vote for him because of foreign policy issues, although his promise to keep America out of foreign wars does chime with many voters (not that Biden has sent troops overseas although has supplied US made weapons to Ukraine). They did vote for him to tackle immigration, especially at the southern border, and address cost of living issues especially food inflation.

The question around immigration could reach a climax as soon as his week. During his campaign Trump boasted of deporting immigrants from Day 1 of his presidency and so it will become clear very quickly how that plays out. Immigration though will continue to be a controversial issue as the entire billionaire elite which now surround Trump are dependent on immigration as a source of human capital. Whether it be Trump’s property empire requiring cheap workers to build buildings or Musk’s need for tech savvy immigrants working under H1-B visas the conflict is clear for all to see.

Food inflation is also going to pose a real challenge. Trump’s go to economic tool of tariffs will only increase prices of many goods which will hit the lower earners, and his MAGA voter base disproportionately. Trump, Musk and Zuckerberg have little interest in the price of eggs, but eggs may become a major problem in the coming years. Part of the rise in food, especially egg prices, is the growing spread of avian flu amongst the poultry population in America. Already it has resulted in millions of birds being culled to try and stop this deadly disease. Fewer chickens mean fewer eggs and that means higher prices. The damage to the bird population is already well documented but a greater risk is if avian flu jumps to humans and widespread human to human transmission occurs. Human deaths by bird flu are already documented but normally of those who have a lot of direct interaction with the birds. Widespread human to human transmission could be devasting. Flu unlike covid targets both young and old and the danger of a zoonotic jump has been a major medical concern for many years. If such an outbreak comes during Trump 2 then America has the worst possible person in charge of health. Robert F. Kennedy Jr. has a multi-decade track record of being anti-vaccination and a promoter of quack remedies. He was an early opponent of the covid vaccine and if bird flu were to become a human problem his involvement would seriously impact any science-based response. Ironically RFK Jr talks a lot of sense when he complains about the ultra-processed foods that many Americans consume daily and so parts of his agenda to Make America Healthy Again ring true, but this can’t undo the damage of his anti-vax work.

All on him

Trump will be tested in the coming months. The current environment is already challenging enough for a strong and tested team. The Ukraine war, the Californian wildfires, the ongoing trade tensions with China, possible Taiwan invasion and a still far from settled middle east will provide plenty of trouble spots which defy simple Trumpian posts or pronouncements. But at least with him in the White House is becomes harder to blame everyone else now. The buck will stop with him and then on the Republican party which could well come to regret their embrace of this most volatile of characters.

An optimistic take on what could come over the next few months and years is that Trump is a maverick, prepared to say and do what others won’t. The world faces a slew of difficult challenges and electorates around the world are clearly dissatisfied with the status quo and the traditional politicians who have ignored them time and time again. It should be remembered that although Trump started out in 2017 as a friend to Xi Jinping and China it was his trade war and turn against China which allowed a much more open discussion and focus on the risks that China posed not only to America but to the world. After years of ignoring the warning signs with Xi’s turn away from reform and opening Trump’s actions completely reframed China relations. Can we expect something unexpected this time around? Almost certainly, but whether the outcome is for better or worse is unknowable. The only certainly is uncertainty.

カテゴリー

最近の投稿

- 習近平の思惑_その2 台湾への武器販売を躊躇するトランプ、相互関税違法判決で譲歩加速か

- 習近平の思惑_その1 「対高市エール投稿」により対中ディールで失点し、習近平に譲歩するトランプ

- 記憶に残る1月

- 高市圧勝、中国の反応とトランプの絶賛に潜む危機

- 戦わずに中国をいなす:米国の戦略転換と台湾の安全保障を巡るジレンマ

- トランプ「習近平との春節電話会談で蜜月演出」し、高市政権誕生にはエール 日本を対中ディールの材料に?

- A January to Remember

- Managing China Without War: The U.S. Strategic Turn and Taiwan’s Security Dilemma

- 「世界の真ん中で咲き誇る高市外交」今やいずこ? 世界が震撼する財政悪化震源地「サナエ・ショック」

- 中国の中央軍事委員会要人失脚は何を物語るのか?