Enter The Dragon

According to the Lunar calendar this weekend ushers in the year of the wooden dragon. Aside from all the familial celebrations those following the stock market in China will be relieved to enjoy a long 5 trading day holiday. Prices can’t fall when the market is closed!

The past few weeks have seen a flurry of official activity to try and boost a flagging stock market and while it has resulted in significant intraday volatility and some reversals from recent lows the sentiment remains weak, which only echoes almost all other areas of the economy as well. This is the second time during Xi’s decade plus long reign that the regulators have thrown everything at the market. Threats and warnings about negative or bearish market reports and research have been issued. There has been some direct state direct buying to provide a floor under certain stock prices. There are restrictions on short selling and on just outright selling by large investors. The head of the China Securities Regulatory Commission, Yi Huimin was replaced by the previous head of the Shanghai Stock Exchange, Wu Qing. And of course the regulator and officials have pledged to boost investor confidence and root out bad practice and malicious activity but are woefully short of details on how this will be achieved. A cynical observer may wonder why the regulator didn’t stop bad practice and malicious activities before this. But cynical observers don’t get a voice in today’s China so that is why thousands of individuals have taken the US embassy in China’s Weibo social media page to complain about the poor market performance.

All these “rescue measures” are well known to long time China watchers but the circumstances now are very different from when Xi called in the rescue team back in 2015. In mid-2015 a 3 trillion RMB credit and leverage induced bubble burst and the market largely ceased functioning when many stocks became untradable because they had either been suspended or had hit their limit down trading price. But this time it is a very different marketplace. There was no bubble, no massive build up of credit and leverage borrowing against shares. Instead we have had a worsening and persistently negative environment and the slow drip, drip, drip of falling prices. This market collapse is more a chronic problem playing out over months and years rather than the acute collapse of 2015 which played out day to day at times. Approximately 6 trillion USD of market capitalization has been lost by investors across the three Chinese exchanges of Shanghai, Shenzhen and Hong Kong since the recent peak of February 2021.

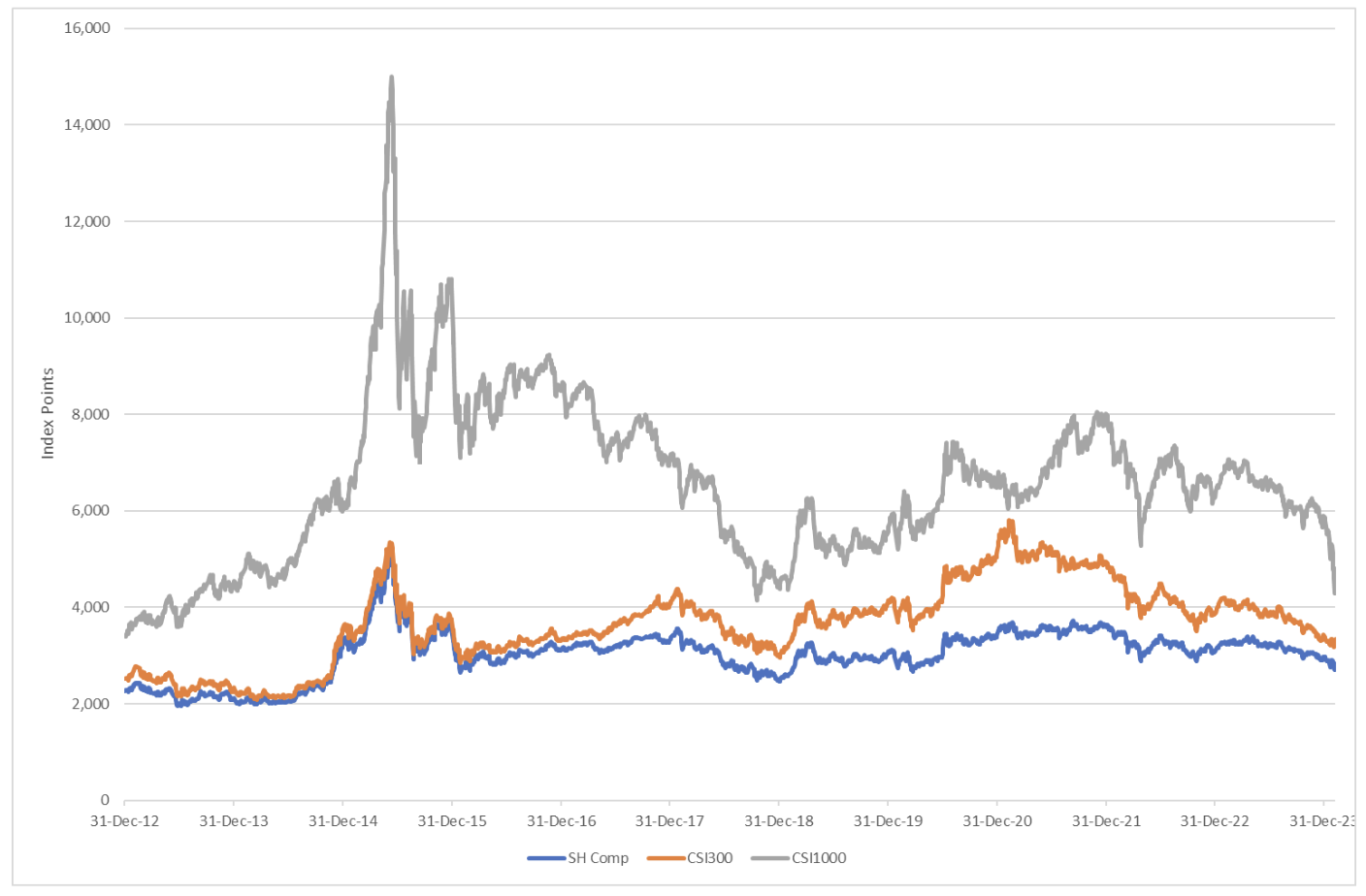

Not unsurprisingly what little direct buying has come from the state has been focused on larger companies, which are almost always, state owned enterprises so it has been the smaller companies, normally tracked by the CSI1000 index which has seen some of the worst falls.

Xi Era Stock Market Performance

Index performance of three well tracked indices on the Shanghai and Shenzhen Exchanges. Shanghai Composite tracking all Shanghai stocks, CSI300 tracking the largest 300 companies across both exchanges and the CSI1000 tracks 1000 smaller companies across both exchanges. Data Source: WIND Information.

But this time is different

China is no stranger to boom and busts of its stock market, nor to rescue packages and pleading from investors for some sort of government bailout. But the concerns around the market have a different feel to them this time. As mentioned, the crash of 2015 was a bubble bursting, as have previous routs going back even further to say 2007. And while trading volumes are well down from their highs the market is turning over 100 bn USD of value a day. This is hardly a market that has been deserted. Yet ample liquidity within the capital markets is hiding some of the broader concerns.

While highly visible the stock market and equity financing has played a minor role in terms of corporate fund-raising compared to both bank loans and bond issuance when looked at in aggregate. But bank loans and bond issuance don’t serve smaller and private companies well. For a good sized SOE bank loans are a way of life, for a private company they are often out of the question. So the market serves, albeit imperfectly, an important part of the Chines growth engine. It is the turn away from the private sector under Xi Jinping which is one of the reasons why the continuing decline of the market is causing such worry amongst investors, both domestic and foreign.

The chronic market malaise is happening within a period of sustained deflation and an economy which is in the doldrums. Whatever the headline GDP growth number says that does not capture the overcapacity in the economy and the anemic private consumption which is dragging on the broader economy.

But most importantly perhaps is this middle-class wealth destruction is happening during the most prolonged and significant property market downturn ever. This is best captured by the recent Hong Kong court decision to move ahead with the bankruptcy and liquidation of China Evergrande. The Evergrande story is hardly news and its collapse has been playing out for years but as the Hong Kong court said, “enough is enough” and a liquidation must proceed. The chances of the Hong Kong appointed liquidators being able to actually execute their mandate within the mainland PRC is very demanding at best, and impossible at worst but that doesn’t minimize the very real problems within the property sector.

For decades the two “great” speculative, and non-taxed markets in China were stocks and property. If one was flagging, then funds would flow into the other and vice versa. Whether such flows and offsets were true was never very clear but these were the means of wealth creation in China and now both have suffered long term blows with a central government which not only is bereft of meaningful support measures also seems broadly indifferent to the impact of prioritizing control and ideology over economic reform and pragmatism. With trillions of USD worth of value written off from the stock market and far more bleeding in the property market valuation Xi Jinping has been the largest destroyer of middle-class asset value since the start of the reform period.

The Government Response

The broad malaise across the Chinese economy is hardly a new story. This column wrote at the start of 2020 how the coming decade was going to be full for difficult challenges for Xi and the Chinese leadership and the underlying concern there was economic. The dependence on debt and credit has been building since before the global financial crisis but because much of the debt was hidden off balance sheet or shadow financing the problem went unnoticed by many for too long. For those who did notice it their voices were often drowned out the China cheerleaders who pointed to strong growth and massive stimulus following the GFC.

For the stock market the level of underperformance is frankly startling. The Shanghai Composite index is probably the best-known market measure within China. That index peaked in late 2007 at just over 6,000 index points. But the first time the current level of 2,800 was hit was in early 2007. By way of comparison, in early 2007 the US Dow Jones index was around 12,000 index points and that index is now 0ver 38,000 index points. Shanghai and the Chinese market look more like the long-term slump which afflicted the Tokyo market for so many years but ironically now the weak yen has made Japanese stocks a favourite of investors and the bubble era peak for the Nikkei 225 is now within reach of the market. Importantly though that return to market highs is not accompanied by the incredibly high real estate prices which drove so much of the Japan bubble era.

For market participants the question is whether the government response is going to change sentiment, and that seems unlikely. Underlying any market has to be the performance of the listed companies, the ability to raise funds and the strength of the economy. By those measures there is little room for optimism. The continuing deflation within the country will do nothing to boost confidence or spending that will continue to show in corporate bottom lines. Domestic investors, the vast bulk of which are members of the urban middle-class, are being squeezed from all sides and their greatest store of wealth, their properties, are in danger of collapsing in value. That hardly breeds a bullish streak, instead the incentive is to hunker down and preserve as much capital as they can. For entrepreneurs looking to build companies the Xi years have become ever more brutal as entire industries and sectors can be eradicated overnight through regulation if Chairman Xi doesn’t see that business fitting into his grand vision of a rejuvenated China. For foreigners years of underperformance by listed companies, a hardening attitude to foreigners and foreign capital and an increase in shear hassle of dealing with China now means that China investing just isn’t worth the effort for many of them. The great irony here is that under Xi Jinping many of the final barriers to full participation in the capital markets have been removed, but now the desire to invest has gone although the investment channels are as open as they have ever been.

The common story coming out of business circles within China is that the government seems devoid of good ideas and certainly no good policies to try and change what is happening. They just don’t know what to do. Xi’s grand speeches of national rejuvenation are worthless in terms of actual policy making to boost an economy when so much of what has been put in place over his reign is to limit the freedoms of business and individuals. In the recent slew of market boosting measures for the stock market the sacking of Yi Huimin as CSRC head is perhaps the least important but reflective of a political and party system which wants to find villains and guilty parties who have done something wrong. Yet Yi did nothing wrong, and certainly isn’t responsible for the poor economy. He may still be charged with some misdeeds, but Xi’s anti-corruption campaign has become a rolling purging machine of those who fall foul of his dreams.

Market moving announcements during the lunar new year are not uncommon but there is no silver bullet or indeed some massive buying spree which is going to change the dynamic in China. There is no easy solution for the chronic ills of the exchanges nor is there a painless solution for the property crunch. The continued economic weakness will only force even greater repression within China, which in turn will only harm economic recovery even more. There will remain bright spots within the economy, the dominant position of Chinese companies within the EV and battery supply chains is likely to continue although that may face difficulties as parts of the developed world reject Chinese high-tech investment, but these industries cannot make up for the broader weaknesses and legacy of years of unproductive debt fueled investment.

The stock market headlines are not chronicling the bust of some recent boom but the eventual realization that the miracle economy has ended. The commonly held assumption that the Chinese economy was bound to overtake the size of the US economy will prove no truer than when the same was claimed for the Japanese economy over 30 years ago. China as a geopolitical and economic force within Asia and world is not in doubt but at last the time for a more rational and sober assessment about what it is and is not is now upon us.

カテゴリー

最近の投稿

- 習近平の思惑_その1 「対高市エール投稿」により対中ディールで失点し、習近平に譲歩するトランプ

- 記憶に残る1月

- 高市圧勝、中国の反応とトランプの絶賛に潜む危機

- 戦わずに中国をいなす:米国の戦略転換と台湾の安全保障を巡るジレンマ

- トランプ「習近平との春節電話会談で蜜月演出」し、高市政権誕生にはエール 日本を対中ディールの材料に?

- A January to Remember

- Managing China Without War: The U.S. Strategic Turn and Taiwan’s Security Dilemma

- 「世界の真ん中で咲き誇る高市外交」今やいずこ? 世界が震撼する財政悪化震源地「サナエ・ショック」

- 中国の中央軍事委員会要人失脚は何を物語るのか?

- 個人の人気で裏金議員を復活させ党内派閥を作る解散か? しかし高市政権である限り習近平の日本叩きは続く