Reasons to be hopeful

Xi Jinping is probably feeling a bit hopeful at the moment. Across a range of issues things are going his way, or at least not working against him. Not only has a truce of sorts been called with the US on the trade war, albeit with tariffs still at high and ultimately damaging levels. The Chinese have clearly been able to use their rare earth supply chain leverage to tame the worst of the Trumpian temper, and a US Federal Appeals court has called Trump’s tariff policy illegal, which if upheld by the US Supreme Court will again create the chaotic uncertainty of a few months ago.

On the diplomatic stage Xi is playing host to the Shanghai Cooperation Organization and will host a grand military parade later this week to mark the end of World War 2. Significantly in this new Trumpian era Xi is meeting with his Indian counterpart Narenda Modi. Numerous US administrations have looked to India to play a balancing role to China in the broader Asian geopolitical sphere. The QUAD grouping of the US, Australia, Japan and India was clearly intended to check China’s diplomatic and military expansion in the regime. On a personal level, always very important to Donald Trump, strongman leader Modi was seen as a natural ally of the President. Yet Trump has played hardball with India regarding tariffs, not only angry with Indian protectionism but also with India’s buying of Russian crude oil, refining it and exporting of the end products. The net result then is US-India relations in freefall and Modi being welcomed in China with Xi calling on both “civilization countries” to partner together, be friends and good neighbours and that the “dragon” and the “elephant” should come together. (On a historical note, it should be remembered that elephants used to roam as far north as Beijing yet centuries of environmental destruction led to their eventual extinction within China!) Such diplomatic victories are only short term and underlying tensions and suspicions will remain.

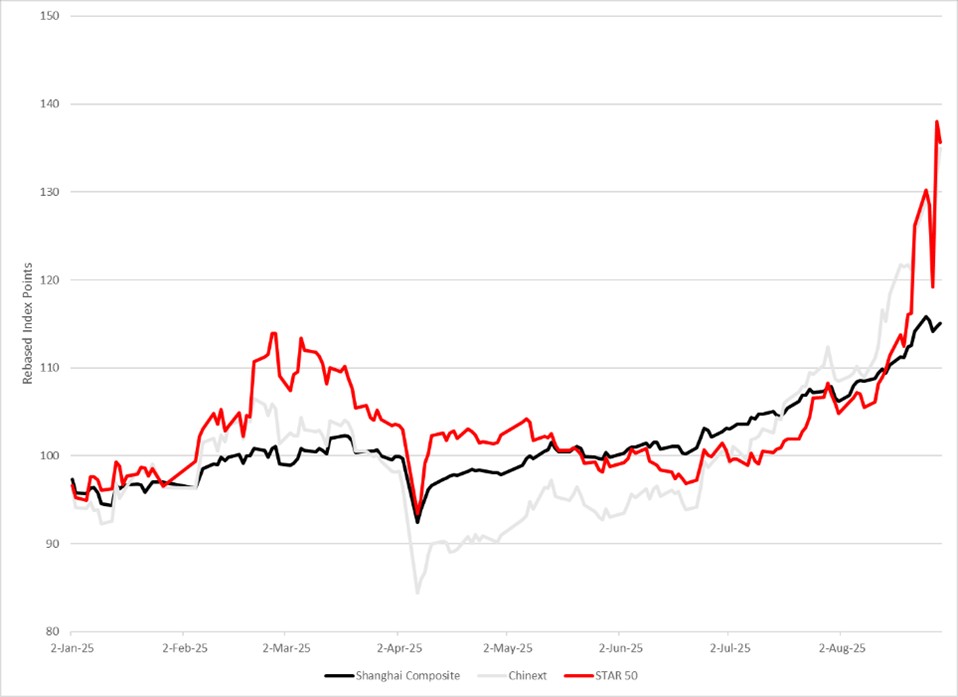

Xi also has some welcome news from an unexpected quarter, the stock market. Early last year this column called Xi the asset destroyer as under his reign the property market and stock market had if not quite collapsed then had at least completely run out of steam. The property market remains under pressure as vast debts and excessive supply continue to be absorbed by the economy, but the stock market is on a tear. Over the summer the markets rallied anywhere from 15 to 35% depending on the specific index.

Year to Date Shanghai Composite, ChiNext and STAR50 index performance

Source: Wind Information

The Shanghai Composite covers all stocks on the Shanghai Exchange and is often used a broad market indicator. ChiNext and STAR50 indices are used to track, smaller, generally private and companies involved in new technologies.

It is ironic then that while the headline story is that stocks are at 10 years highs only last week Evergrande, the largest private property developer delisted from the Hong Kong Exchange. The company collapsed under 300 billion USD of debts in the domestic property market. The recent rally is going to do anything to mitigate the ongoing ripples of that property failure.

Chinese stocks have largely fallen off the radar screen of foreign investors. A few years ago China was described as un-investable by foreign investors. In a environment where Chinese investment brought political scrutiny many large fund managers decided that China was simply too troublesome an investment location. It’s not as if China had ever been an easy place to invest. For decades investment restrictions made getting money into China at best a hassle and at worst impossible. That coupled with rampant corruption, booms, busts and insider trading made tradition fund managers struggle to come to grasp with the market. Many of these very real limitations remain but China’s markets are far more than these negatives. China’s markets boast excellent settlement and trading infrastructure and incredibly high market liquidity. China now hosts a huge range of domestic fund managers and traders who simply have no choice but to invest in Chinese A shares because capital controls mean they cannot invest outside of China. This current rally has been driven by domestic investors, both state and institutional, riding a wave of surplus liquidity which the central bank has injected into the economy as it tries to revive the broader economy and property market. Stocks though are proving a more interesting and immediate return.

And like trading in most of the world’s largest markets, a significant percentage of the volume is driven by algorithmic-based trading, i.e. by computers tracking trading signals, not humans making value decisions on the underlying companies. These “traders” are always active and reading to increase volumes as trends build in the markets. The picture of Chinese markets being driving by hordes of small retail investors is a fiction and hasn’t been true this century. Chinese markets are dominated by professional traders and institutions, the retail investors who do jump in when the market rallies are not unimportant but are not the dominant driver.

Does it matter?

After decades of boom and bust in China the question which is implicit in any Chinese rally is whether this time is different? Will it all end in tears? As recently as during Covid, as China enjoyed their covid-free bubble there was a rally, yet it ultimately fizzled out.

Some commentators have talked about this rally being a “slow bull” market and downplay suggests of a bubble. At this stage it would certainly be premature to call the rally a bubble, it has few signs of the excesses of 2007/8 or 2015. A decade ago the market was significantly smaller in terms of market capitalization and the leverage in the market, both official and unofficial, was significantly higher. The very broad CSI1000 index which tracks the middle ranking companies in China still remains at only half of the level it reached in 2015. Brokers too are more proactive now in limiting leverage, but the history of all markets tells us that nothing attracts money like a rising stock market. No doubt many foreigner investors which had ignored China will have another look simply because of the recent headlines which this short rally has generated. To that end it is likely that the market will continue to rally further from current levels but perhaps the most sobering comparison for today’s market is that the Shanghai Composite index peaked back before the Global Financial Crisis in late 2007. The Chinese stock market has been broadly range bound for nearly two decades. In comparison the US markets back then were approximately one third of their current levels. Whatever happens in Chinese stocks it is always important to understand that they operate and perform with only the loosest of correlations with the underling economy or corporate fundamentals. That statement isn’t true for all individual companies and without doubt China has created some world beating companies in selected fields, but the broader stock market is a poor proxy when trying to gauge the broader economy, and just as importantly any middle-class wealth effect. Statistics from the depository have shown consistently over a number of years that the number of active stock accounts is far fewer than is often thought. Half of all accounts opened are inactive and many investors use multiple accounts to hide their trading actively. There are individual investors of course, and since it is China the absolute number is large, (China is full of large numbers) but it’s wrong to think that a rising stock market and the associated capital gains can make up for the losses suffered by the middle classes in the property market or indeed provide an sustainable long term return the way the property market did.

The latest rally does send a signal though, and that is that China always has the capacity to surprise. Writing China off as un-investable is true in certain ways but for Chinese themselves it is their home and their own market whatever the imperfections. The closed capital account and large liquidity within the country means that the stock market is always able to come into play. China has failed to build a long-term sustainable stock market would have been a huge asset to the economy and investors but instead it has bits of one. Great market infrastructure and hardware to move money around but a market driven too much by policy whim, liquidity and speculation. A rising market can’t do anything to change the ageing demographics of China but a better developed market which actually reflected the very real growth of the economy over the past thirty years would have been a tremendous asset to the pension industry which is failing to provide adequate provision for the ever-growing number of retiring workers.

The stock market can also be a model to understand other parts of the economy. China’s capacity to manufacture and produce goods across all industries isn’t just fading away. China’s determination to lead in the field of electric vehicles or new energy has come with tremendous waste and inefficiencies but the leadership has achieved their goal.

It is doubtful whether Donald Trump understands any of this, but it is essential for his team, or those who come after him and are trying to compete with China that they understand that China isn’t simply going to go away or be beaten. China is an ongoing challenge for decades. To frame the competition between the US and China as a “race” is to misapply the term. A race finishes, it is a set activity, yet the competition between the US and China will be one, not of equals, but of two very large countries and economies each with their own strengths and weaknesses which has no set finish line.

Trump and others within the MAGA ecosystem seem to live in or pine for a bygone age. They look to some time in the American past as the place they want to return the country to. If by extension they think that China will revert or return to the China or the 80s or 90s then they are sorely mistaken. China’s factory of the world isn’t going to disappear even if some production moves overseas. Misallocation of capital within the Chinese economy will continue, that is the price the state is prepared to pay to achieve its goals. How sustainable it remains and what costs it imposes on society will become clearer but the industrial capacity and human capital which has been created in the past decades will remain. Chinese society, like America, will continue to operate with high levels of inequality but the best in China will often mean best in the world. For American policy makers, and for others in Asia or Europe, that means it is essential to pick you China battles wisely. Chinese leaders have looked to control key industrial sectors and bottlenecks and that need to be addressed by foreign leaders but don’t expect that China will give anything away.

Such a complicated and ongoing competition cannot be won by tariffs alone. Tariffs and government policy support can play a role to restore some of America’s industrial prowess but it is a limited tool and sadly the only one Trump seems to have at the moment.

As policy makers busy themselves with China they might be tempted to watch the stock market rally further and expect an economic revival is coming soon. That’s the wrong lesson to learn, but they certainly shouldn’t think that China is collapsing anytime soon either.

カテゴリー

最近の投稿

- Internationalizing the Renminbi

- 習近平の思惑_その3 「高市発言」を見せしめとして日本叩きを徹底し、台湾問題への介入を阻止する

- 習近平の思惑_その2 台湾への武器販売を躊躇するトランプ、相互関税違法判決で譲歩加速か

- 習近平の思惑_その1 「対高市エール投稿」により対中ディールで失点し、習近平に譲歩するトランプ

- 記憶に残る1月

- 高市圧勝、中国の反応とトランプの絶賛に潜む危機

- 戦わずに中国をいなす:米国の戦略転換と台湾の安全保障を巡るジレンマ

- トランプ「習近平との春節電話会談で蜜月演出」し、高市政権誕生にはエール 日本を対中ディールの材料に?

- A January to Remember

- Managing China Without War: The U.S. Strategic Turn and Taiwan’s Security Dilemma