The State Council of China outlined a 19-point policy package on 26th August, including another 300 billion Chinese yuan renminbi (yuan) that state policy banks can invest in infrastructure projects, on top of 300 billion yuan already announced at the end of June. Local governments will be allocated 500 billion yuan of special bonds from previously unused quotas.[1]

According to the Bloomberg report, China stepped up its economic stimulus with a further 1 trillion yuan ($146 billion) of funding largely focused on infrastructure spending, support that likely won’t go far enough to counter the damage from repeated Covid lockdowns and a property market slump.

In fact, China’s State Council had proposed a 33-point package of policy items which help “get the economy back on a normal track” on the 25th May.[2] What’s wrong with China’s economy of domestic sector?

Investment, consumption and export have always been regarded by the China’s government as the troika driving GDP growth. China’s economic growth is mainly driven by foreign trade exports. Investment and consumption are usually just levers for dealing with external or global economic crisis.

For example, during the Asian financial crisis in 1998, China proposed a policy of expanding domestic demand, and provided investment in housing, automobiles and other fields to promote the release of consumer energy. Besides, China once again promoted the policy of expanding domestic demand, through investment in infrastructure, such as railways, highways, airports and water conservancy, and home appliance products going to the countryside in the period of 2008 global financial crisis.

Domestic demand policies. In the first half of 2020, China’s exports maintained a growth rate of 13.2%, but compared with 28.1% in the same period in 2021, China’s export capacity lagged behind significantly. In anticipation of a decline in export sales, China once again adopted a package of domestic demand policy, especially emphasizing consumption to boost the economy. Since the Fifth Plenary Session of the 19th Central Committee of the Communist Party of China (CPC), the CPC has emphasized expanding domestic demand as a strategic basis, and expanding domestic demand has become an important policy to stimulate China’s economic growth.

However, the latest package isn’t enough to turn the economy around. It will create more public demand that will partially fill a growing hole left by a retreating private sector — giving some support to growth. Bloomberg Economics criticized that “What it won’t do is deliver a confidence boost that’s needed to prompt households to spend more and companies to invest more. “

National fixed asset investment from recession to recovery. China’s national fixed asset investment (exclusive farmer household) reached the top of 35% in the January-February 2021. Due to the outbreak of epidemic, the figure gradually declined to the bottom of 4.9% in the January-December.[3] Compared with the 12.6% increase in the national fixed asset investment return and the 15.4% increase in private investment in the same period in 2021. China’s national investment and private investment have declined significantly. However, China’s national fixed asset investment dramatically increase to 12.2% in the January-February 2022. The first half of China’s national fixed asset investment increased by 6.1%, but private investment only increased by 3.5% in 2022.[4]

The role of state-owned (or state-controlled) enterprise. Another indicator also shown that the cumulative growth ratio of China’s national fixed assets by state-owned (or state-controlled) and private enterprise investment dramatically declined from 6.8% and 4.7% in December 2019 to -23.10% and -26.42% in February 2020. National fixed assets investment fell by double digits in the first four months.

When the epidemic became stable, the cumulative growth ratio of China’s national fixed assets dramatically raised to 32.9% and 36.4% in February 2021. After CPC inquired state-owned (or state-controlled) enterprises to resume operations earlier in June, the cumulative growth ratio of state-owned (or state-controlled) enterprises’ national fixed assets quickly turned to the positive. The percent of China’s national fixed assets investment of state-owned (or state-controlled) and the private enterprise gradually enlarged in August 2022.[5]

Source: MacroMicro.me

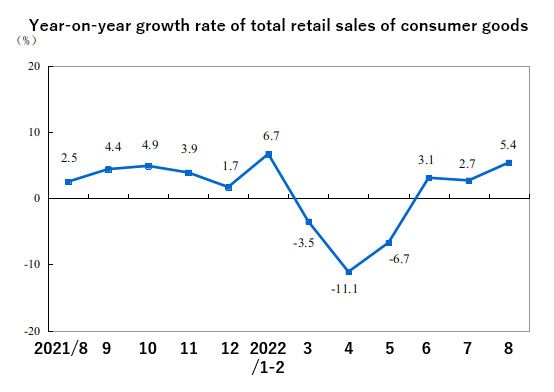

Lockdown and the consumption. The investment rate of the government and the private sector has gradually increased, but the low consumption in the domestic market has caused China’s economic structure to be unbalanced. In 2021, the total retail sales of consumer goods in China reached 44 trillion yuan, an increase of 12 times compared with 3.68 trillion yuan in 2000. However, since 2021, the total retail sales of consumer goods in China declined month by month, falling to 1.7% compared with the same period in December. This may be related to the strict zero-epidemic prevention policy and lockdown measures in many major cities of China.

For example, when Shanghai was closed due to the epidemic, the total retail sales of consumer goods declined the bottom of -11.1% in April. After the lockdown was lifted in June, the total retail sales of consumer goods raised to 3.1%. In the first half of the year, the growth rate of total retail sales of consumer goods was -4.9% over the same period.[6]

Source: National Bureau of Statistics, China

The contribution of consumption to GDP become important. From 2011 to 2020, the proportion of consumer spending to GDP averaged 53.3% in China. Compared with the proportion of consumer spending to GDP averaged 80% in the West developed countries, China’s consumption is still not enough to support the heavy responsibility of GDP.

In 2018, the contribution of consumption to China’s GDP was as the highest record as 76.2%. In 2021, the contribution rate of China’s consumption expenditure to GDP growth is 65.4%, which is higher than 20.9% of exports of goods and services and 13.7% of total capital formation. China’s consumption contributed 5.3% of the annual GDP growth in 2021.

The State Council has repeatedly emphasized the need to carry out structural reforms on the supply side, the purpose of which is to expand domestic demand and create room for economic growth. The key is to make Chinese residents willing to consume, able to consume, and dare to consume.

However, under the new crown epidemic, repeated Covid lockdown and dynamic zero-epidemic prevention policies, Chinese residents have become less able to and afraid to consume than in the past. At the same time, Chinese households also face high debt ratios, severe unemployment, and an aging population structure before they become rich.

The debt ratio of households upholds a high level. In 2018, China’s household debt accounted for 107.2% of disposable income. This figure is very close to the situation before the 2008 US financial crisis. China’s household debt reached 112.4% of disposable income in 2021. Compared with 2013, China’s household debt to disposable income has doubled.

The debt pressure of urban households is mainly mortgage loans, especially medium and long-term consumption mortgages, which account for 80% of long-term consumption. The second main reason is that household income can no longer cover daily expenses, and the turn to private loans has also increased by 18.3%, which is much higher than the 10% increase of average income in the past decade.

The third reason is the rising debt in the poor areas, where households in urban areas have higher incomes and can still repay their loans. However, in Inner Mongolia, Xinjiang, Shandong, Tibet and other rural regions with low-income levels, they cannot pay for their daily necessities. Many households still have to pay short- and medium-term loans, resulting in severe economic pressure.

Premier Li Keqiang of the State Council once said that there are 600 million residents in China whose monthly income is only 1,000 yuan in 2020. Under the influence of the new crown epidemic, the per capita disposable income of Chinese residents has dropped significantly, particularly in rural areas and these inner provinces.

Unemployment. In 2021, in order to prevent the unconditional expansion of capital, CPC imposed strong supervision on industries such as real estate, supplementary education, entertainment, and online games. Tencent, Alibaba, Didi and other tech giants have been forced to lay off staff due to the decline in revenue under the strict regulation.

In order to reduce the expenditure of families on children’s education and the burden of students who need to go to tutoring after class, the Chinese government also introduced a double reduction policy for the tutoring industry. Let China’s education and training industries, such as New Oriental and Good Future’s stock collapsed, and thousands of teachers in the training industry lost their jobs.

Flexible employment. According to a survey by the Chinese Academy of Social Sciences, the national unemployed population in May was as high as 5.9%, and the unemployment rate in 31 large cities was as high as 6.9%. However, the number of newly added jobs in May was only 1.23 million. In addition to 10.67 million college graduates, migrant workers, laid-offs and veterans will enter the job market. In order to solve the problem of unemployment, the Chinese government has created many new titles for flexible work in an attempt to stabilize the unemployment plight.

The State Council of China issued the “Opinions on Supporting Flexible Employment through Multiple Channels”, which regards supporting flexible employment as an important policy for stabilizing employment and ensuring the employment of residents. According to Chinese statistics, there are currently more than 200 million people in flexible employment. It summarizes delivery workers, online car-hailing, online celebrities, freelancers, temporary workers, part-time workers, street vendors, and odd jobs as flexible employment.

An aging society. China is rapidly entering an aging society, and the population aged 60 to 65 is rapidly increasing. China, with its aging population and declining birthrate, has become a society that is not rich but aging first. The income of the elderly population is much lower than that of the young. Therefore, the retirees will continue to reduce consumption, which will have a more adverse impact on China’s domestic demand market.

Overseas consumption. The China government insisted the supply-side reforms to stimulate consumer spending in the domestic market. According to the survey, the reasons why Chinese people are reluctant to consume domestically are mainly due to the inability to supply high-quality goods and services in China’s domestic market, on the other hand the high willingness of Chinese high-end consumers to consume abroad.

A large amount of consumption by Chinese residents goes overseas. The service trade occurred the deficit in 2000. In 2010, the service trade deficit was 101 billion yuan. In 2018, the service trade deficit was the highest, with a deficit of 1.7 trillion yuan, mainly due to the large amount of consumption expenditures by Chinese people to travel overseas and study abroad. In 2020, the service trade deficit narrowed down to 692.9 billion yuan, mainly because of the previous epidemic that restricted Chinese from leaving the country. The service trade deficit still be as high as 211.3 billion yuan in 2021.[7]

Relieving financial pressure of local government. At the end of May, the State Council promulgated 33 ways to bring the economy back on a normal track. Some of measures to stimulate the economy are intended to support local government finances. In addition to paying for epidemic prevention funds, local governments need to rely on infrastructure and real estate to supplement local financial resources, and they are also responsible for dealing with unfinished buildings left by previous real estate companies.

When the efficiency of a 33-point package of policy items to promote consumption is yet to be tested at months ago, 19 new economic stimulus programs have been promulgated again. Various packages of economic stimulus measures need regulation and scroll adjustment. In the short term, it is optimistic to activate the domestic consumption market due to both indicators, national fixed asset investment and the total retail sales of consumer goods, shown the uptrend of China’s economy. In the long term, we concern that there will be more challenges in the downside of the China’s economy.

[1] These Are China’s 19 New Measures to Bolster Economic Growth. https://www.bloomberg.com/news/articles/2022-08-25/these-are-china-s-19-new-measures-to-bolster-economic-growth?fbclid=IwAR2k3FVFD_Uh_92dQF5wyhmw04U3nLWp75pZPyX72yAGhOiTGKoPm_i-E60&leadSource=uverify%20wall

[2] China has 33 ways to get economy back on track, but critics say ‘adjusting zero-Covid strategy is key’. Ji Siqi, https://www.scmp.com/economy/china-economy/article/3178989/china-has-33-ways-get-economy-back-track-critics-say?fbclid=IwAR1kHwwD6JiU2WwqwXlFL0qg0C3cI5RGgA0Krbo3oUMbNmjZ_EonN-idOqE

[3] 2021 China’s national fixed asset investment (excluding rural households), National Bureau of Statistics, China, http://www.stats.gov.cn/tjsj/zxfb/202201/t20220117_1826405.html

[4] 2022 China’s national fixed asset investment (excluding rural households), National Bureau of Statistics, China, http://www.stats.gov.cn/tjsj/zxfb/202209/t20220916_1888303.html

[5] https://www.macromicro.me/collections/30/cn-investment-relative/298/cn-investment-actually-completed-state-owned-state-controlled-enterprises-vs-private-growth-rate

[6] Total retail sales of consumer goods in August 2022 increased by 5.4%, National Bureau of Statistics, China. http://www.stats.gov.cn/tjsj/zxfb/202209/t20220916_1888301.html

[7] http://data.mofcom.gov.cn/fwmy/overtheyears.shtml

カテゴリー

最近の投稿

- 習近平の思惑_その3 「高市発言」を見せしめとして日本叩きを徹底し、台湾問題への介入を阻止する

- 習近平の思惑_その2 台湾への武器販売を躊躇するトランプ、相互関税違法判決で譲歩加速か

- 習近平の思惑_その1 「対高市エール投稿」により対中ディールで失点し、習近平に譲歩するトランプ

- 記憶に残る1月

- 高市圧勝、中国の反応とトランプの絶賛に潜む危機

- 戦わずに中国をいなす:米国の戦略転換と台湾の安全保障を巡るジレンマ

- トランプ「習近平との春節電話会談で蜜月演出」し、高市政権誕生にはエール 日本を対中ディールの材料に?

- A January to Remember

- Managing China Without War: The U.S. Strategic Turn and Taiwan’s Security Dilemma

- 「世界の真ん中で咲き誇る高市外交」今やいずこ? 世界が震撼する財政悪化震源地「サナエ・ショック」