After eight years negotiations, the Regional Comprehensive Economic Partnership Agreement (RCEP) was formally signed on the afternoon of November 15, 2020. It is the largest global FTA ever and is a comprehensive, modern, high-quality and mutually beneficial FTA. This FTA has the world’s largest population, most diversified membership structure, and the most promise. The RCEP includes access to markets for trade in goods, trade in services and investment. It also includes a large number of rules for friendly trade, intellectual property rights, e-commerce, competition policy and government procurement. It covers all aspects of trade and investment liberalization and facilitation. With a population of 2.3 billion, a total GDP of more than $25 trillion, and encompassing 25% of global trade, the agreement will create more in-depth cooperation between the manufacturing strengths of China, technological strengths of Japan and South Korea, the labor strengths of ASEAN countries and Australia and New Zealand’s natural resources. This makes the agreement the most significant trade agreement in the world in history. Signing the RCEP greatly demonstrates or accelerates TPP and TTIP negotiations.

1. Impact of signing the Regional Comprehensive Economic Partnership Agreement (RCEP)

First, the RCEP will be a recycling strategy for Asian economies, which will keep manufacturing industry in Asia and simultaneously, enhance the Asian science and technology R&D capability and gradually form an industrial chain throughout Asia. In the short term, this is a significant opportunity for Asia to take the lead in emerging from the economic crisis in the post-epidemic period. It will also enhance Asia’s manufacturing capacity and economic integration as a whole, over the long term. The RCEP is another milestone of the world’s regional integration, following the EU. Signing the RCEP is beneficial to member countries as it widens consumer market choices and reduces corporate trade costs. Drawing on the experience of Japan, South Korea, Taiwan, and emerging economies such as India, Brazil, and South Africa, uniting open economies will support the value of high-quality assets such as stocks, bonds, foreign exchange and housing over the long-term.

The RCEP will also enhance Chinese companies’ prospects. Signatories such as Japan, South Korea, and Australia are all ranked within China’s top ten trading partners, while ASEAN as a whole is China’s largest partner. Therefore, as the world’s largest trader of goods, China further strengthens its trade with member countries, making conditions even more favorable for Chinese products to enter and expand in foreign markets.

Third, the RCEP a benefit as is it facilitates China’s internal circulation. China has the world’s largest domestic market and it has become an international market that multinational companies must compete in, as the domestic population’s demand for high-quality products is increasing every day. The China International Fair for Trade in Services and the China International Import Expo were held successively in the second half of 2020, allowing the world’s outstanding enterprises with their high-quality and inexpensive goods to move into the Chinese market smoothly. It is beneficial to the Chinese market’s internal circulation, as well as to the construction of an integrated upstream and downstream supply chain for domestic companies, and it promotes the Chinese economy’s recovery and healthy development.

Fourth, the RCEP is beneficial as it will drive the economic recovery of countries all over the world. Among the 15 countries that have signed this agreement, China accounts for half of the total GDP in imports and exports, and has more than half of the region’s population, making it a hugely promising market. In addition, China’s economy has tremendous room for development and will play an essential role in global economic development. Signing the RCEP makes it easier for the relevant countries to get a head start into the Chinese market and to drive their economic recovery.

Fifth, the RCEP is also beneficial for learning and cooperation in areas other than the economic area. From a geopolitical perspective, it will improve the surrounding environment for China’s development. The participation from U.S. allies such as Japan and Australia shows that more and more countries share China’s philosophy of cooperation rather than confrontation. It is beneficial because it encourages full cooperation on political will, and also strengthens and enhances political exchange between signatory countries. It also provides the benefit of sharing Chinese experience in epidemic prevention and the use of Chinese vaccines.

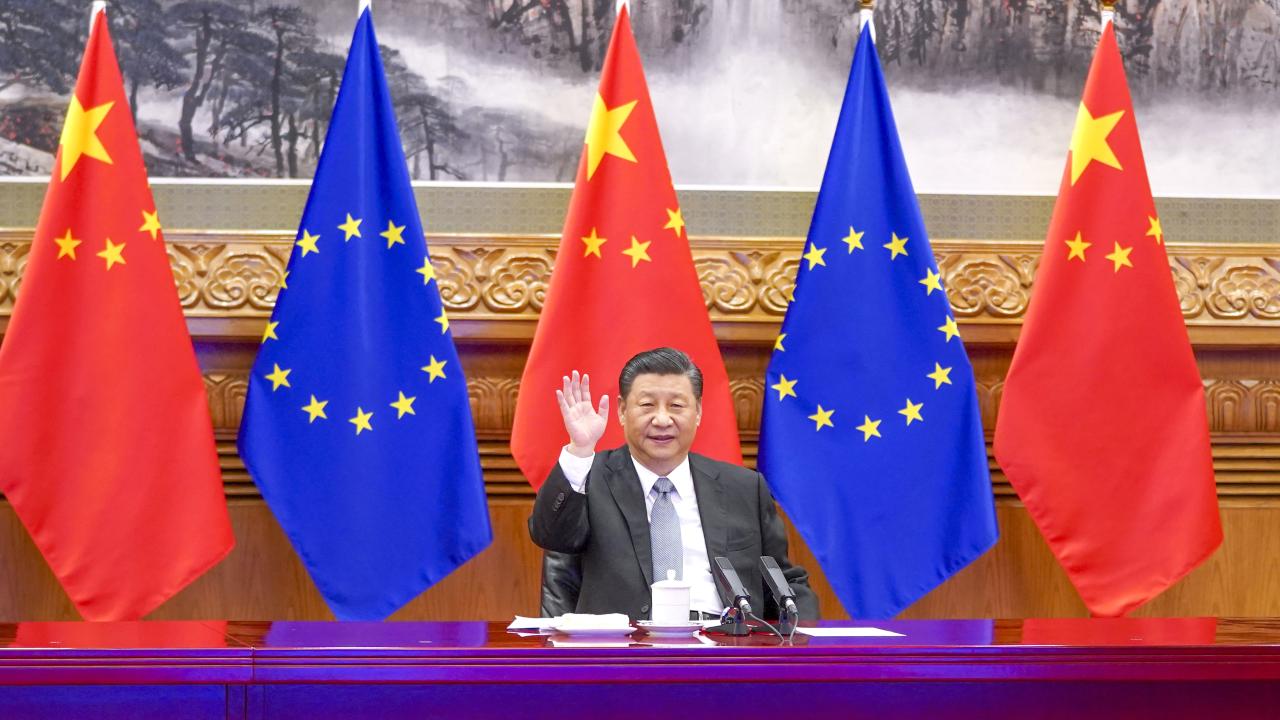

2. How the signing the RCEP and EU – China Comprehensive Investment Agreement affect the E-CNY

First, the RCEP will lead to reduced dominance of the US dollar and a relative rise in the status of the renminbi.

After several tranches of quantitative easing, US debt exceeds $ 28 trillion. The largest holders of US debt are Japan and China. Countries now prefer to hold the renminbi than the US dollar, which has suffered a credit crisis. As the epidemic has progressed, China has become the world’s safest place. Investors are bullish on predictions of the Chinese economy’s stability, and the renminbi’s value gradually rising. China is the world’s second-largest economy and its most resilient. With the domestic epidemic under control and the renminbi recognized as a kind of settlement currency in at least 35 countries worldwide, countries like Iran have made the renminbi one of their foreign exchange currencies, replacing the US dollar. Saudi Arabia and Russia both tend to sell their oil in renminbi, and it will become a reserve currency for many countries.

Secondly, it encourages accelerated implementation of digital currencies and accelerated de-dollarization in countries around the world.

As the US has increased its debt to crisis levels regardless of other countries’ interests, other countries have responded with counter attacks of hedged liquidity risks by reducing US debt and increasing their gold holdings. Prior to this, countries all over the world have always held US dollars and never challenged the hegemony of the US dollar. By increasing renminbi currency swaps and import/export mechanisms, the developing E-CNY can be used to gradually replace part of the US dollar market, which will dramatically accelerate the pace of renminbi internationalization and further increase Asia’s ability to resist financial crises. It is beneficial to the stability of the Euro and to Asian currencies such as the JPY and the KRW and even to the stability of their economies.

3. What impact will it have on China’s position in the supply chain

Signing the RCEP and the EU – China Comprehensive Investment Agreement will further unleash East Asia’s economic vitality and growth potential, add new impetus to promoting the region’s development and prosperity, and lay the groundwork for EU – China cooperation. The RCEP includes not only Japan, South Korea, Australia, and New Zealand, which are highly-developed countries, but also China and the ASEAN countries, which have the highest economic growth. This region also has a more mature international manufacturing sector, a labor network and robust economic complementarity. Standardized economic and trade rules and a convenient cross-border business environment will inevitably encourage in-depth integration of the countries’ supply chains and so facilitate the Free Trade Area of the Asia-Pacific (FTAAP).

First, due to the pace of China’s upgrade to its industrial structure, the country’s low-technology industries are sure to move away from first-tier cities, mainly to third and fourth-tier cities in China, but also to Southeast Asia. Signing the RCEP may prompt inflows into Southeast Asia and into the countries in the “Belt and Road” initiative. China can implement new technologies and markets through the RCEP regional value chain and move upstream in the manufacturing sector. With help from the RCEP, China can seek out business opportunities with neighboring countries and establish a unified system of trade rules throughout the Asia-Pacific region. In the long run, the demographic dividend and stable domestic environment of ASEAN member countries are also favorable towards China’s low-end industrial chain and will help China achieve its leap into the high-end industrial chain. It is beneficial to Chinese consumer electronics, home appliances, communication equipment and other high-end manufacturing industries. Chinese food and metal processing industries will also benefit from this partial transfer, due to lower costs.

Second, it rebuilds the Asian regional value chain and the global trading system. The RCEP will enable China to gradually reduce its dependence on US and European markets and enhance its economic cooperation with Japan and South Korea. By developing standard rules of origin adapted to the region, China is able to join the world trade system via Asian regional integration and to find a way round other less favorable trade rule. After the agreement comes into effect, Chinese enterprises will be helped by the RCEP with their smooth integration into the international industrial chain. Imported products will cost less, imports will increase and the trend of industrial offshoring may accelerate. From a long-term perspective, Chinese companies that achieve full industry chain coverage, coupled with the advantages of a huge domestic market, will allow China to gradually move upstream in the industry chain in many areas after the RCEP is signed. It will also enhance development opportunities for imports and cross-border e-commerce.

Of course, signing the RCEP brings its own challenges. Machine manufacturing, photoelectric manufacturing and other medium and high-end industries may be affected in the short term. Australia, which has industrialized agriculture, has extremely low production costs due to its large-scale production. Myanmar and Thailand, which have not yet industrialized, will lower their exchange rates to facilitate increased agricultural exports. Provisions in the RCEP prohibit agricultural export subsidies. Five essential Chinese agricultural products namely rice, wheat, pork and beef, dairy products and sugar, will lose their export subsidies, which will affect Chinese farmers’ incentive to grow staple foods and raise livestock.

4. If China decouples from the Western countries, how long will it take to establish its own economic circle?

First of all, there are left, center and right factions and their spokespeople in every country. It is not these spokespeople, let alone their radical speeches, that determine the country’s fundamental interests, but rather the general aim of maximizing all sides’ interests. China and the United States are the world’s two largest economies, and the economic ties between the two countries are determined by their complementary economic structures and the openness of the global economy. A complete decoupling is not realistic; both sides’ fundamental interests are best served by cooperation: decoupling would be harmful to both. China and European countries have signed an investment agreement, indicating that these two regions are cooperating, not decoupling. Japan and South Korea are closely tied to the Chinese economy, and are inseparable from China. In the game between great powers, fighting is inevitable, but the fight must be to preserve peace, and any war, even if it leads to winners and losers, is ultimately for the sake of peace. Therefore, it is inevitable that there will be peace after the struggle, and so complete decoupling of China and the Western countries is purely hypothetical, while limited decoupling is a reality. Realistic decoupling will only be shown in political slogans, in economic sanctions in some regions, in ad hoc diplomatic rhetoric and reciprocal sanctions, and not by absolute decoupling. Specifically, the world’s largest production capacity must be absorbed by the entire global market. The same is true for the United States, where the world’s highest volume of capital must seek out the world’s largest production capacity as the basis for issuing its currency. Money represents physical goods, and without China’s productive centers, which transform raw materials and technology into actual products and services, it would be challenging to absorb all the dollars issued. This would freeze the dollar which would lead to a global financial collapse. China and the United States need each other, which is the heart of the issue, and they will not completely decouple.

To take a step back, even if China returns to an agrarian society, it would still have its own independent economic circle. The ancient Chinese economy basically relied on its internal circulation, and only exported tea, ceramics, silk, and other items to foreign countries. Except for a few luxury items, there is no need to import daily necessities from outside the country. China, as we know, is now in an open era, and hopes to establish two economic circles: inner and outer. The inner economic circle can be built up entirely by internal demand, while the outer economic circle, mentioned above, will rely on the mutual demand by both China and the rest of the world. Despite some resistance, they are both being built. Whether the outer economic circle, will be established quickly or slowly, and whether it will be to a high or low standard, will be discussed separately. I maintain that the Chinese economic circle has been established historically and is now in line with the present day. Due to the Chinese government’s determination to reform internally and to open up to the outside world, the two economic circles in China and abroad will grow bigger and better in the future, creating a virtuous circle.

カテゴリー

最近の投稿

- 習近平の思惑_その1 「対高市エール投稿」により対中ディールで失点し、習近平に譲歩するトランプ

- 記憶に残る1月

- 高市圧勝、中国の反応とトランプの絶賛に潜む危機

- 戦わずに中国をいなす:米国の戦略転換と台湾の安全保障を巡るジレンマ

- トランプ「習近平との春節電話会談で蜜月演出」し、高市政権誕生にはエール 日本を対中ディールの材料に?

- A January to Remember

- Managing China Without War: The U.S. Strategic Turn and Taiwan’s Security Dilemma

- 「世界の真ん中で咲き誇る高市外交」今やいずこ? 世界が震撼する財政悪化震源地「サナエ・ショック」

- 中国の中央軍事委員会要人失脚は何を物語るのか?

- 個人の人気で裏金議員を復活させ党内派閥を作る解散か? しかし高市政権である限り習近平の日本叩きは続く